Authorities Bust Craigslist Ponzi Scheme

Massachusetts securities regulators filed charges against an Alabama company and its principals alleging that the company targeted investors through the popular online classified website Craigslist and promised extraordinary returns of 100% in as little as 48 hours. The Massachusetts Securities Division ("MSD") filed an administrative complaint against Premiere Asset Management, Inc. ("PAM"), as well as PAM principals and/or employees Gerald Lawler, Nicola Lawler, Mariam Williams, Claude L. Collins, Sr., and Patrik Granec, accusing the defendants of violating the Massachusetts Uniform Securities Act through the fraudulent and unregistered sale of securities. The MSD is seeking a cease-and-desist order, a bar from future employment in the securities industry, restitution, and administrative fines.

Massachusetts securities regulators filed charges against an Alabama company and its principals alleging that the company targeted investors through the popular online classified website Craigslist and promised extraordinary returns of 100% in as little as 48 hours. The Massachusetts Securities Division ("MSD") filed an administrative complaint against Premiere Asset Management, Inc. ("PAM"), as well as PAM principals and/or employees Gerald Lawler, Nicola Lawler, Mariam Williams, Claude L. Collins, Sr., and Patrik Granec, accusing the defendants of violating the Massachusetts Uniform Securities Act through the fraudulent and unregistered sale of securities. The MSD is seeking a cease-and-desist order, a bar from future employment in the securities industry, restitution, and administrative fines.

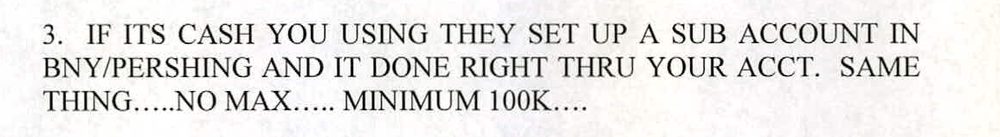

According to the MSD, at least one Massachusetts resident - a public school teacher - responded to an advertisement on Craigslist.org in March 2014 which offered an investment opportunity with a return of 100% in as little as 48 hours. After some back-and-forth, the investor wired $100,000 to an Alabama on the promise that PAM would provide a "tender cash credit and leverage of $200,000 USD..." PAM represented that investor funds would be used for "purchase, sell and/or loan of banking instruments or securities and/or etc." Several weeks later, the investor contacted PAM to inquire about the investment. PAM informed the investor that the investment had increased to $200,000, and the investor agreed to reinvest $145,000 of the amount while withdrawing the remaining $55,000. PAM subsequently ceased contact with the investor.

An investigation by authorities revealed that PAM principals and associated individuals opened up several accounts at Regions Bank, including two bank accounts in the name of Premiere Asset Management that were subsequently closed by the bank. An examination of pertinent banking activity showed that at least one other similar deposit of $100,000 was made - presumably representing an additional unidentified investor lured by the Craigslist advertisement. The Complaint further discloses that PAM's website should have triggered warning bells given its generic and plagiarized language and representations.

Red Flags Were Readily Apparent

The program is totally 100% secure under your sub accout (under your client) with most reputable bank in NY, bank of Melon [sic]. This is privilege not a need to be part of it."

The multiple spelling and grammatical errors should have raised concerns over the individual to whom the investor was contemplating handing over a significant portion of their wealth, and should have at least prompted further investigation. These deficiencies were also apparent in an overview provided to investors describing the program, a portion of which provided that:

It appears the investor may have noticed these red flags, as a subsequent email to the unidentified PAM agent stated that:

It appears the investor may have noticed these red flags, as a subsequent email to the unidentified PAM agent stated that:

My brother is my financial consultant...[h]e thinks [the money] will be gone if I give you the bank info...he said it looks like another scam from Craigslist.

Yet, despite taking the affirmative step of seeking advice from a knowledgeable and impartial third party, the investor decided to move forward with the investment and confided that the sum represented "all [of] my retirement money." In response, the PAM agent reassured the investor that:

There is NO risk and you are with TRILLION dollar asset holding bank. You don't need to be worry about anything!

Unfortunately, it appears that the investor's brother's concerns were well-founded.

A copy of the MSD's Complaint is below:

E 2014 0092 Administrative Complaint